Global Supply Shortages: What’s the Legacy for CEMs?

5th January 2022

It’s only in the last two years that electronics supply chains have become noticeably strained. This may sound like a relatively short amount of time, but for many in it now feels like a permanent feature of the industry.

Contract manufacturers have arguably faced the hardest job throughout this period, having to manage longer lead times and more expensive parts on one side and high expectations from customers on the other. While most businesses have become aware of the market’s realities, and adapted accordingly, some still adopt a ‘pre-shortage’ mentality that overlooks the fierce competition for raw materials and components taking place each day.

And this is without factoring in the pandemic, which has only served to make matters much worse. Indeed, today is a far cry from twenty years ago when there was so much excess component inventory that huge volumes of product had to be sold at a loss by manufacturers, distributors and customers.

It’s difficult to say how long current bottlenecks will last but the market is already adapting. With that in mind, here are five important changes I expect to become permanent features for the CEM industry once normal service resumes – whenever that may be.

1. Extra is Now Standard

There was a time when CEMs could receive an order, buy and assemble parts, then ship the product without too much dialogue from customers. However, this simple transaction is now virtually impossible in the current climate, and even long-term customers are having to engage more with their partners – especially when specified parts are having to be swapped out for alternatives on a regular basis.

Offshore Electronics has always offered an ‘extra as standard’ model, making use of its team of engineers to identify and source credible parts when original designs have required slight modifications. At one time, only a handful of customers required the business to be proactive but now the market is making this approach a necessity, simply because every order will require room for manoeuvre if customers want to keep their lead times to a minimum. Bob Schulz, Manufacturing Director at Baldwin Boxall and one of Offshore’s customers, sums up the situation: “It was inevitable that sourcing alternative components was going to be necessary but this process can be time consuming. Offshore has been able to exploit its supply network and make proactive decisions because the company’s staff understand the technical nature of our products, ultimately saving us time having to locate and review for ourselves”.

2. Engineering Expertise Will Be Key for Repeat Business

Buying on a ‘per project’ basis was common two years ago, but this is currently impossible. In today’s fraught market, CEMs need autonomy to secure parts – and that includes minimum order quantities and the ability to make a call when material prices fluctuate – but they also need an ongoing dialogue with customers that rarely featured before supply chain troubles hit.

Purchasing professionals, for example, would rarely have spoken with in-house electronics designers or engineers as preferred components could be secured without issue. Now, though, alternative parts are needed for virtually every order, so conversations need to be had to fulfil contracts without creating further, unnecessary delays. Dialogue is also key for a rapid response when going to market to secure stock.

This new arrangement has encouraged more productive relationships between businesses and their outsourced partners, and can only be seen as a good thing. These high service expectations, however, will likely remain after the worst has passed. CEMs who roll back on this will likely see their prospects of repeat business go elsewhere.

3. Pragmatism

Difficult trading conditions naturally force organisations to rethink their plans – especially product launches. And it’s not just smaller organisations that are having to do this. Even household names like Sony have had to delay flagship products simply because there is little recourse to global shortages, no matter how influential a brand may be. As such, pragmatism has become the default approach for anyone looking to navigate troubled waters and keep schedules roughly on track.

But it’s not just the supply chain that’s forced a change in attitude. Delays have created a knock-on effect throughout the industry, with CEMs now booked up for many months in advance as organisations realise there are no shortcuts open to them. If someone, for example, approached Offshore and requested an eight-week turnaround I would make every effort to accept the work, but equally some projects simply aren’t achievable in the current climate. It’s better to be honest with customers than take on complex work which is impossible to complete within a tight window.

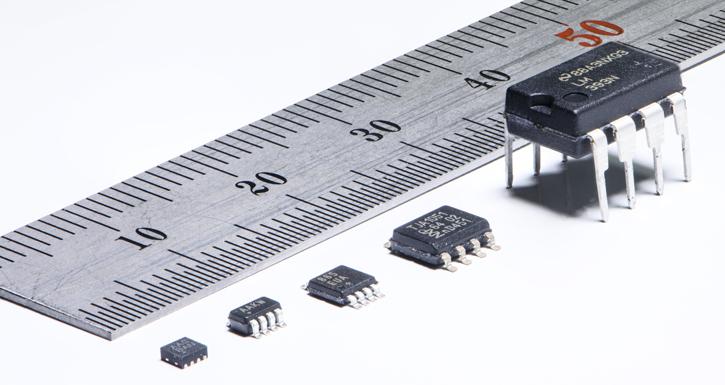

Of course, this attitude will fade as product begins to flow again but a realistic approach will remain key – not least because scarcity could easily become a problem again in the near future. Semiconductors, for example, are still only made by two companies and the cost to build new infrastructure is still prohibitive for all but the largest global players.

4. No More Just in Time

Customers placing regular, scheduled orders has been one of the few positive changes to come out of the last two years – and it’s an approach that looks set to stay. Schulz again points out customers’ change in approach: “Our business is life and safety, so product continuity is paramount. We now review our forecasts and commit to advanced orders with the assurance that materials are on the way or, ideally, already at Offshore’s facilities. This approach shields us from all but the worst issues and also gives the business more flexibility should demand fluctuate, which is common in ‘project-led’ industries like ours. Excess stock also gives us the opportunity to generate sales, should we have any”.

Working this way ultimately gives CEMs better visibility moving forward and, with consistent order books, the ability to invest in new people, equipment and processes in a more sustainable way. These benefits can then be passed back to customers seeking outsourced services capable of quickly scaling up according to demand.

5. Local, Not Global?

Virtually every part of the global electronics industry is currently at capacity – including raw materials from metalworks and plastic suppliers – meaning those who moved their manufacturing overseas in the last decade have seen little in return over 2020 and 2021. Few CEMs offering budget assembly will have the time to seek suitable alternatives, let alone consult on possible design changes, leaving many businesses struggling to cut their long lead times.

Problems have only been made worse by the current cost of freight and power outages in key regions, like China. Far from being the leaner, economic approach, having product stuck thousands of miles away has actually helped drive costs up in an already difficult climate. Whether these issues will see businesses repatriate their manufacturing is difficult to say but the prospect of local support is certainly more attractive right now.

Dan Attewell is Technical Sales Director at Offshore Electronics. For more information, visit: https://www.offshore-electronics.co.uk/